Medical equipment depreciation calculator

Section 179 deduction dollar limits. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash.

1

This limit is reduced by the amount by which the cost of.

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of. There are many variables which can affect.

Depreciation cost value salvage value x depreciation rate in You can calculate the depreciation rate by dividing one by the number of years of useful lifean item with a useful. Medical equipment is often depreciated over five or seven years. Once you have determined an item should be capitalized you will then need to calculate a useful life.

9 rows Market Value Calculator. ATO Depreciation Rates 2021 Medical ATO Depreciation Rates 2021 Medical 122. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules.

Depreciation Calculator High-Tech Medical Equipment Depreciation Calculator The calculator should be used as a general guide only. Find the high low and average price of any used medical. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash.

High-Tech Medical Equipment - Systolic Monitor Depreciation. The depreciation of an asset is spread evenly across the life. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash.

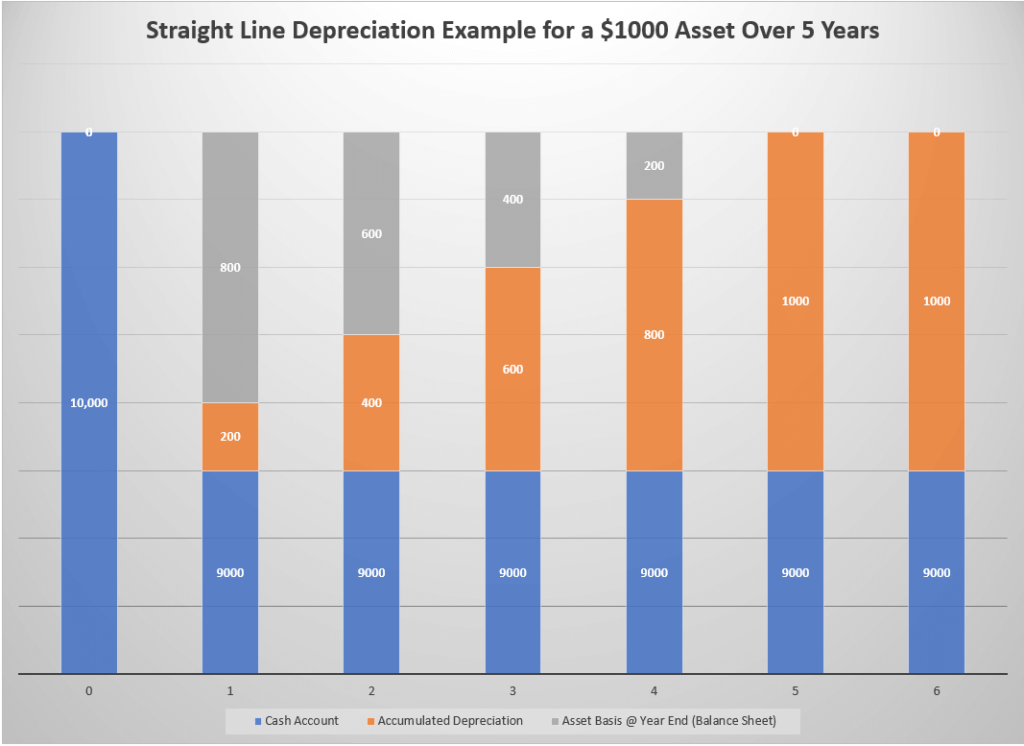

The straight line calculation as the name suggests is a straight line drop in asset value. HOME PROVIDERS DOCUMENTS NEWS CAREERS EVENTS TOOLS STORMWATCH TECHNOLOGY. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Also includes a specialized real estate property calculator.

For example if an asset is purchased for 100000 and its salvage value is 10000 after five years a facility can expect the asset to depreciate by 90000 throughout those five years. This depreciation calculator will determine the actual cash value of your Systolic Monitor using a replacement value and a 7-year lifespan which equates to 007 annual depreciation.

Accumulated Depreciation Overview How It Works Example

How To Calculate Depreciation Expense

What Is Equipment Depreciation And How To Calculate It

1

What Is Equipment Depreciation And How To Calculate It

1

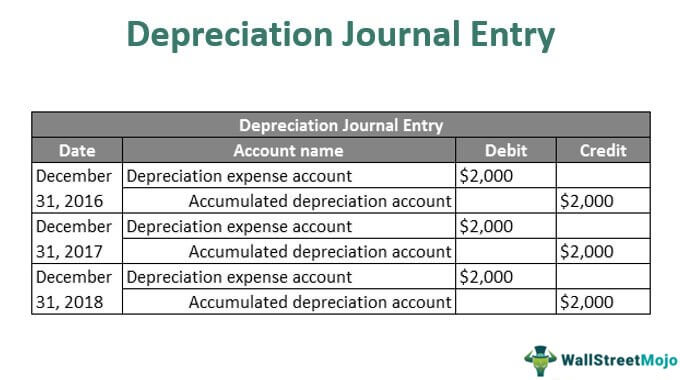

Depreciation Journal Entry Step By Step Examples

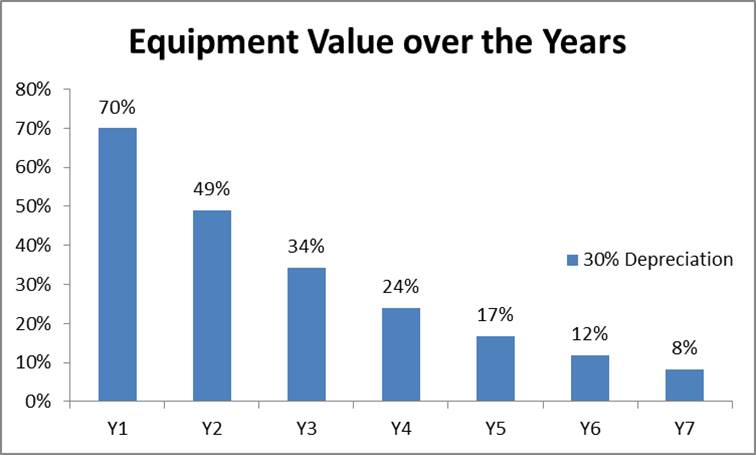

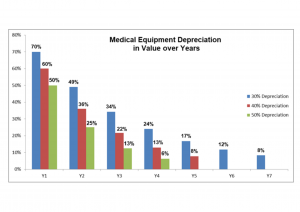

Medical Equipment Value At 30 Depreciation Rate Primedeq Blog

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Amp Pinterest In Action Chart Of Accounts Business Tax Deductions Accounting

Used Medical Equipment Valuation How Much Should You Pay

Straight Line Depreciation Accountingcoach

1

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Straight Line Depreciation Accountingcoach

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance