11+ a real estate loan payable in periodic installments

Payable for at least 10 years or until you reach age 65. PART 1024REAL ESTATE SETTLEMENT PROCEDURES ACT REGULATION X Subpart AGeneral.

Solved Calculating An Installment Loan Payment Using Simple Chegg Com

A loan contract to which 342251 applies and that is payable in a single installment may provide for an acquisition charge and an interest charge on the cash advance that does not exceed a rate or amount that would produce the same effective return determined as a true daily earnings rate as allowed under 342252 considering the amount and term of.

. Now i have to pay commissions to the real estate salesperson under me from the same transactions. A the loan must be voluntarily created with the consent of each owner of your home and each owner s spouse. Bonds payable in installments.

A 165000 mortgage loan will be paid in 180 monthly installments. Loan amount and recast are defined in 102643b5 and b11 respectively. In exchange you agree to pay an additional rent amount of 3000 payable in 60 monthly installments of 50 each.

You must capitalize the 3000 and amortize it over the 20-year term of the lease. You use the cash method of accounting. When computing equity in real estate or allowable motor vehicles and the taxpayer has not submitted substantiation of loan balances claimed on the Form 433-AOIC OEOS should request a credit.

Section 18A3B-11 - Organization of council selection of officers. B This Contract is contingent on Buyer obtaining written loan commitment which confirms underwriting loan approval for a loan to purchase the Property Loan Appr oval within _____ days if blank then 30 days after Effective Date Loan Approval Date for CHECK ONL Y. B the principal loan amount at the time the loan is made must not exceed an amount that when added to the principal balances of all other liens against your home is more than 80 percent of the fair market value of your home.

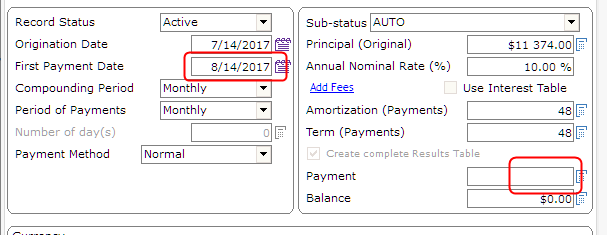

So i received net commissions of 90 percent after deducting the CWT. There will be a payment of 112759 during the first 36 months and the payment would adjust to 127064 for the remaining 144 months. 15 YEAR EXAMPLE for 31 Smart Rate Adjustable Mortgage 285 Interest Rate 371 APR 400 Fully Indexed Rate 0 points.

We welcome your comments about this publication and suggestions for future editions. Your amortization deduction each year will be 150 3000 20. On May 1 2021 you borrowed 40000 from your retirement plan.

Section 18A56-15 - Income of funds. The loan wasnt used to acquire your main home. In 2021 you took out a 100000 home mortgage loan payable over 20 years.

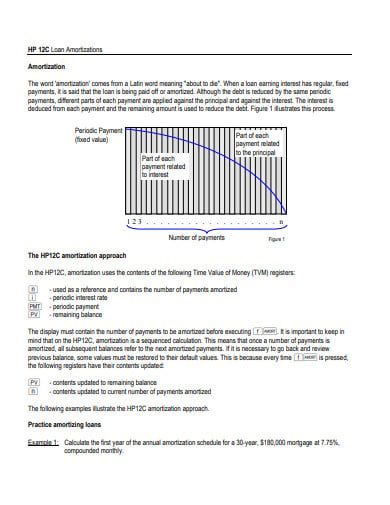

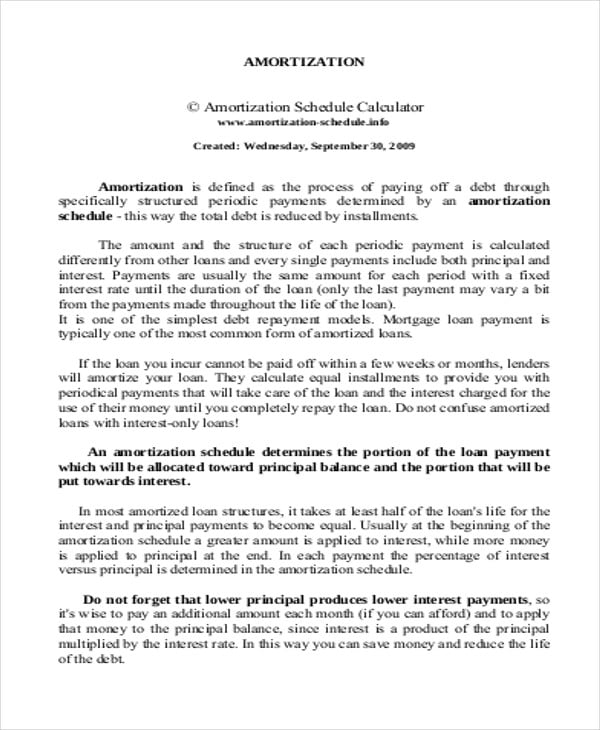

Interest on the portion of the tax in excess of the 2 portion is figured at 45 of the annual rate of interest on underpayments. Equated monthly installments are used to pay off both interest and principal each month so that over a specified number of years the loan is fully paid off along with interest It further explains that with most common types of loans such as real estate mortgages the borrower makes fixed periodic payments to the lender over the course of. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

This is loan repayment by equal periodic instalments including accrued interest on the outstanding balances calculated to pay off the debt at the end of a fixed period. A fee of 150- 200 is payable for each site visit conducted by Bank officials. The term does not include charges as a result of default additional charges Section 37-3-202 delinquency charges Section 37-3-203 or deferral charges Section 37-3-204 or in a consumer loan which is secured in whole or in part by a first or junior lien on real estate charges incurred for appraising the real estate that is collateral.

The loan was to be repaid in level monthly installments over 5 years. An application means the submission of a consumers financial information for purposes of obtaining an extension of credit. Servicing means receiving any scheduled periodic payments from a borrower pursuant to the terms of any federally related mortgage loan including amounts for escrow accounts under section 10 of RESPA 12 USC.

Citizens and can find more information in other IRS publications at IRSgovForms. Sale of real estate held or acquired. Application to local finance board.

Section 18A3B-12 - Executive board. You made 3 monthly payments on the loan in 2021. You werent in the uniformed services during this period.

For such a loan 102618s4iii requires creditors to disclose the fully amortizing periodic payment for each interest rate disclosed under 102618s2ii in addition to the minimum periodic payment regardless of whether the legal obligation explicitly recites that the consumer may make the fully amortizing payment. A reverse mortgage is a loan where the lender pays you in a lump sum a monthly advance a line of credit or a combination of all three while you continue to live in your home. The information in this publication is not as comprehensive for resident aliens as it is for nonresident aliens.

Payment of premiums on bonds. You paid 4800 in points. For transactions subject to 102619e f or g of this part the term consists of the consumers name the consumers income the consumers social security number to obtain a credit report the property address an estimate of the value.

Servicing means receiving any scheduled periodic payments from a borrower pursuant to the terms of any federally related mortgage loan including amounts for escrow accounts under section 10 of RESPA 12 USC. A loan given to purchase real estate. Paid real estate or personal property taxes.

Table A provides a list of questions and the chapter or chapters in this publication where you will find the related discussion. For a loan on which only interest and no principal has been paid the loan amount will be the outstanding principal balance at the time of the recast. The amount of tax withheld from an annuity or a similar periodic payment is based on your marital status and the number of withholding allowances you claim on your Form W-4P.

I am a real estate broker and registered as a corporation. NW IR-6526 Washington DC 20224. Section 18A24-7 - Change of maturities.

You make nine monthly payments and start an unpaid leave of absence that lasts for 12 months. Payable in equal yearly installments or more often. 2609 and making the payments to the owner.

The terms of the loan are the same as for other 20-year loans offered in your area. 2609 and making the payments to the owner of the loan or other third parties of principal and interest and such other payments with. For an estate of a decedent who died in 2022 the dollar amount used to determine the 2 portion of the estate tax payable in installments under section 6166 is 1640000.

If you are receiving periodic payments payments made in installments at regular intervals over a period of more than 1 year use Form W-4P to have tax withheld from your IRA. Interest-only and Interest-only loan are defined in 102618s7iv. 585204 Updated years in example.

Resident aliens are generally treated the same as US. You can deduct 60 4800 240 months x 3 payments in 2021. Updated to remove inclusion of retired debt for a vehicle loan paid off before the future income period ends.

How much CWT must i withold from the agent na nag override lang ako 10 per cent ba or subcon tax lamang na 2 per cent.

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Loan Payment Schedule 10 Examples Format Pdf Examples

Long First Payment Deferral Versus Normal One Period Month Deferral Margill

Mortgage Amortization Revisited The Cpa Journal

Mortgage Loan Wikiwand

What Is An Installment Loan Definition And Examples Thestreet

29 Amortization Schedule Templates Free Premium Templates

You Plan To Borrow 389 000 Now And Repay It In 25 Equal Annual Installments Payments Will Be Made At The End Of Each Year If The Annual Interest Rate Is 14 How

Mortgage Loan Wikiwand

Free 15 Loan Schedule Samples In Ms Word Ms Excel Pages Numbers Google Docs Google Sheets Pdf

Solved Amortization Schedule For A Loan Pavable Most Loans Chegg Com

Solved Real Estate Loan Payable In Periodic Installments Chegg Com

Mortgage Introducer August 2022 By Key Media Issuu

:max_bytes(150000):strip_icc()/buying-subject-to-an-existing-loan-1798423-27ea8f47081b44c7b2ba85a2326595e2.jpg)

How Subject To Loans Work In Real Estate

How To Calculate A Mortgage Payment Double Entry Bookkeeping

Fully Amortizing Payment Definition

Free 9 Sample Assignment Of Mortgage Templates In Pdf Ms Word